If you are looking for an easy way to budget then the 50/30/20 rule is your best option. Of course there are more simple ways to budget your money such as the half payment method.

The point is to find the best option that fits YOUR lifestyle, and then you will actually stick to your budget and be well on your way to financial freedom!

This post may contain affiliate links, meaning I receive a small commission if you click, at no cost to you. For more information please see my Disclosure

What is the 50/30/20 budget rule?

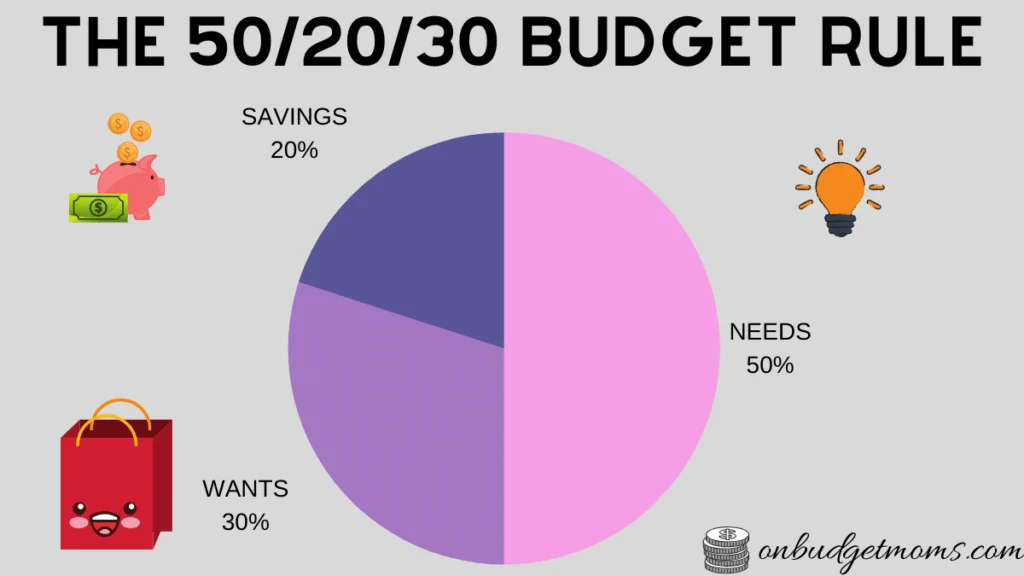

Like I stated above it is a simple way to budget without needing detailed budget categories. You spend 50% of your AFTER tax paycheck on your NEEDS and the remaining 50% you split into two parts.

30% on your WANTS and 20% on savings and/or debt repayment. If you have a lot of debt I would focus on getting that down some then start adding to your savings.

If you need to establish an emergency fund (which I suggest you do) there are ways to get one without using your normal monthly income.

Related: How to get your emergency fund fast without using your income

What is the %50 rule?

This percentage of your budget all goes towards your necessities, think about what you cannot live without.

These categories would include shelter, electricity, food, transportation, clothing and anything you need to have to live day to day.

One thing this section also includes (which many forget) is your minimum debt payments. Since if you do not pay them it can have a dire lasting effect on your life in terms of your finances.

Any minimum payments such as car loans, student loans, credit cards etc.

If you need some help tracking your finances I suggest using the Trim Finance App!

You can do a lot with trim such as automate your savings, get a debt payoff plan, trim will even negotiate your monthly bills to get lower rates!

What happens if you are way over the %50?

Let’s say you add all those up and you are over 50% of your after tax income! Don’t panic, there are ways to lower these numbers.

You can find ways to lower your monthly electrical bill and grocery bill. You can also negotiate your loan rates, some will decrease them by 1-3% which is better than nothing.

If after that, you are still well above 50% of your income then consider trying out the half payment method and come back to this once you have lowered some of your debts.

Related: 8 Simple Steps to Get out of Debt this Year

What is the 20% rule?

Now this would be for your personal finance goals such as savings, debt repayment and 401k.

This does not include short term saving goals like if you were saving for a vacation, that would be in the 30%.

What if you are drowning in debt? Let’s say you have a ton of debt, thankfully we have the minimum payments covered in the 50% category, now you should try and pay off the smaller debts first.

Using the debt snowball method is perfect in this case since you would want to free up some money to put towards a savings as soon as possible.

What is the %30 rule?

This is reserved for all the things that make life better, cable and phone bills fall into this category.

Also entertainment, gym memberships, eating out, hobbies and whatever else you enjoy doing in life.

Naturally in order to keep at the 30% of your income you may need to sacrifice a little bit.

With the internet it is now easier then ever to make extra money, so you could use that for more of your wants.

If you need some budget printables you can grab a few for free, There is also a free 50/30/20 budget printable!

More on Budgeting Below:

10 BUDGET CATEGORIES YOU COULD BE FORGETTING (ORGANIZE YOUR BUDGET)

5 MONEY TIPS TO TAKE YOUR FINANCES TO THE NEXT LEVEL