How To Stick To A Budget

Creating a budget is a great step towards financial freedom, but what happens if you have trouble sticking with it?

I think it is safe to say we have all failed at least once when it comes to staying within our budgets! So, how to stick to a budget, is a legit question to ask and probably a popular one.

Related: 5 Things You Need To Know Before Budgeting

Why is it important to stick to a budget?

If the thought of budgeting has crossed your mind then that means you probably aren’t living within your means, or you simply are having trouble with your finances. Let’s face it when it comes to our finances there is a lot to consider, you have:

- Bills

- Food

- Gas

- Entertainment

- Debt

….just to name a few, so if you are trying to keep track of all that in your head, you are eventually going to mess up!

Now once you create your budget if you don’t stick with it you will find yourself further in debt, making bill payments late, NSF fees, losing money and the list goes on.

This is why it is so important to stick to a budget, there are some misconceptions about budgeting, like you will never have fun, or you don’t get any freedom with your money.

This cannot be further from the truth, YOU are the one creating your budget, it is all in your control!

Plus if you follow my blog you will know I do not suggest cutting fun out of your life, that is a recipe for disaster.

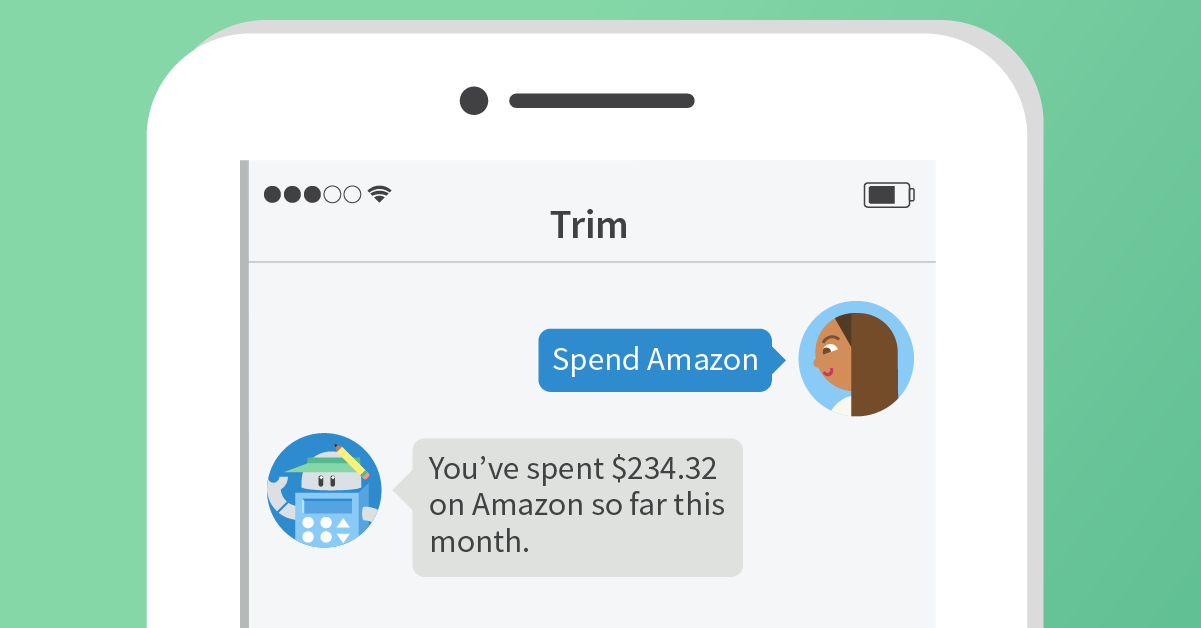

How AskTrim makes sticking to a budget easy

Taking advantage of free tools to make life easier is something everyone should do, this nifty robot can do just that! Trim is an artificially intelligent assistant that helps you manage your finances with ease.

Personally I use Trim to track my spending and set alerts, which is a huge help when it comes to sticking to my budget. You can set reminders for when your bills are due and Trim also tracks your spending to make sure you aren’t going over budget!

There is so much more Trim can do so be sure to check it out!

Now let’s get to the 7 tricks to help you stick to a budget.

Pin for later:

1) Include bad habits: Don’t be ashamed of your bad habits, be real with yourself especially while creating your budget. If you smoke then you need to decide if you CAN quit or cut back, if not be sure to include that as an expense!

2) Pay yourself first: Don’t take this the wrong way, paying off your debt and having a savings is VERY important, however you should find room to give yourself an allowance. This would be considered “free” money that you can spend on whatever you’d like. This trick helps curve the overspending on budgets and gives yourself a sense of freedom with your money.

3) Meal Plan: Food is a huge expense and many over spend on food daily which is why it is so important to meal plan and take a list to the grocery store. If meal planning isn’t your thing and you KNOW %100 you won’t do it, then you should consider the $5 meal plan.

Just as its name states, it is a meal plan that is customized for your family with meals being as little as $2 per person, making it a great choice for saving money on your budget.

Being only $5 per month it is a great option for those who hate meal planning or simply don’t have the time, you have a 14 day risk free trial to test it out as well.

4) Save Always: Save money whenever possible and this will help you stay within your budget. Wouldn’t it be motivating if at the end of the month you still had money left over in your food budget?

There are tons of ways you can save money everyday, even if you are on a low income.

5) Take Your Time: If you enjoy shopping that is fine as long as you are mindful about what you are buying, do some window shopping and take your time before you make a purchase. Personally, I love window shopping, most of the time I even leave without buying anything.

6) Include Others: If you have a family you need to include them in the budget process, if only you make the budget then only you will probably follow it, which is no good. If you are single then choose a friend to be your accountability partner and they will help you stick to your budget.

7) Use Free Money: I know this seems like a strange thing to say, but with the internet these days you have so many opportunities to get free money.

Here are some I use:

Swagbucks: Swagbucks is one of the best rewards programs on the Internet, by earning SB’s you can then exchange them for gift cards, including Paypal.

Rakuten: Always shop through Rakuten and earn cash back, %100 free money!

SurveyJunkie: One of my favorite Survey companies and the most legit, earn some free cash daily.

Use this money to purchase some of your wants, none of this would be included in your budget so it is your money to do as you please.

There you have 7 tricks to help you stick to a budget and pay off your debts! If you have any other tricks you’d like to add, feel free to comment below!

Share and Pin!