When it comes to budgeting, we often look for simple and effective ways to manage our finances. One such method gaining popularity is the cash envelope system. As the name suggests, this system involves the use of envelopes to allocate cash for various spending categories, making it a visual and tangible approach to budgeting. By using cash instead of credit or debit cards, we can keep better track of our spending and avoid overspending.

Frequently asked questions about the cash envelope system

Here are some quick answers to questions you might have about the cash envelope system, continue reading for more details.

What is the cash envelope system?

The cash envelope system is a budgeting method where individuals allocate specific amounts of cash to different spending categories and place the cash in designated envelopes. This method helps people manage their spending and stay within budget for each category.

How does the cash envelope system work?

To use the cash envelope system, individuals create envelopes for various spending categories such as groceries, entertainment, dining out, and transportation. They then allocate a set amount of cash to each envelope based on their budget. When making purchases in a specific category, they use the cash from the corresponding envelope. Once the cash in an envelope is depleted, no further spending in that category is allowed until the next budgeting period.

What are the benefits of the cash envelope system?

The cash envelope system promotes conscious spending by limiting the amount of money available for discretionary expenses. It also helps individuals visualize their spending and encourages them to prioritize their financial goals.

Are there any drawbacks to the cash envelope system?

One potential drawback is the inconvenience of carrying and managing physical cash. Additionally, some individuals may find it challenging to adapt to the strict allocation of funds to specific categories.

How do I get started with the cash envelope system?

To start using the cash envelope system, you can begin by identifying your spending categories and creating envelopes for each. Determine your budget for each category and allocate the appropriate amount of cash to the envelopes. Then, track your spending and adjust your allocations as needed.

Can the cash envelope system be combined with other budgeting methods?

Yes, the cash envelope system can be combined with other budgeting techniques, such as tracking expenses through apps or spreadsheets. Some people use the cash envelope system for discretionary spending categories while using other methods for fixed expenses and savings.

Where can I find cash envelope printables?

Cash envelope printables can be found online on various websites that offer free or paid templates. These printables typically feature different designs and categories to suit individual budgeting needs. Simply download, print, and assemble the envelopes to start managing your cash effectively.

The cash envelope system is quite straightforward and user-friendly. To begin, we must first determine a monthly budget, taking into account all our expenses and income sources. With this information in hand, we can then allocate a specific amount of cash for each spending category, such as groceries, entertainment, and dining out. Once these amounts are determined, we place the allotted cash for each category into its corresponding envelope.

Throughout the month, we then spend solely from the designated envelopes, helping us to remain disciplined and focused on our financial goals. When an envelope runs out of cash, that’s it – no more spending in that category until the next month. This method not only fosters a greater sense of control over our finances but also instills a heightened awareness of our spending habits. The cash envelope system serves as a practical and empowering tool for those looking to achieve financial wellness.

Understanding Cash Envelope System

Origin and Purpose of Cash Envelopes

The cash envelope system is a popular budgeting method that dates back to the early 20th century. The purpose of this system is to help individuals and families manage their finances effectively and avoid overspending. Many people find it difficult to stick to a budget, and the cash envelope system provides a physical and visual reminder of their spending limits.

By using cash envelopes, we allocate a specific amount of money to each spending category, such as groceries, entertainment, and utilities. This process helps us gain a better understanding of where our money goes each month and encourages mindful spending. The cash envelope method can also be a lifesaver for those who are struggling with living paycheck to paycheck and are looking for ways to regain control over their financial situation.

Application of Cash Envelope Method

To implement the cash envelope system, follow these steps:

- Create a monthly budget: Determine your total income and expenses for the month. Be sure to account for all sources of income and essential expenses, such as rent, utilities, food, and transportation.

- Assign spending categories: Divide your expenses into distinct categories, and allocate a portion of your income to each one. Some common categories might include groceries, entertainment, clothing, and savings.

- Fill your cash envelopes: Label an envelope for each spending category with the allocated amount for that category. Withdraw cash from your bank and distribute it among the envelopes accordingly.

- Track your spending: As you make purchases during the month, pay with the cash from the corresponding envelope. This will help ensure that you don’t overspend in any category.

- Adjust as needed: If you find that you’ve overspent in one category, you can either cut back on your spending in that area or reallocate money from another envelope to cover the difference. Just remember to stay within your overall budget!

The cash envelope method is an effective way to manage your finances and stay on track with your budgeting goals. By using this approach, we become more aware of our spending habits and are better equipped to make informed choices about our money.

Setting up the Cash Envelope System

Determining Income and Expenses

Before we set up a cash envelope system, it’s essential to have an accurate understanding of our income and expenses. We’ll start by listing all sources of income and calculating the total amount received each month. Next, we’ll categorize and list our monthly expenses, ensuring we don’t overlook essential budget categories.

To create a zero-based budget, we’ll allocate every dollar of our income to a specific expense category. This approach ensures we have a clear plan for our money and can prevent impulse spending.

Choosing the Right Categories

Selecting the appropriate budget categories is crucial to the success of the cash envelope system. To determine which categories are relevant to our needs, we’ll begin by examining our spending habits and identifying areas where cash spending could benefit us, such as groceries, dining out, or entertainment.

Take the time to review commonly forgotten categories to make sure we’ve covered all our bases. Feel free to explore the 10 Budget Categories You Could Be Forgetting (Organize Your Budget) for more information.

Creating and Stuffing the Envelopes

Once we have our budget categories determined, we’re ready to create our envelopes. These envelopes can be physical or digital, depending on personal preferences. We’ll write the name of each category on its designated envelope.

After creating the envelopes, the next step is cash stuffing. Each month, we’ll withdraw cash from our bank accounts based on the allocated budget for each category and divide the cash among the envelopes accordingly. By using cash, it’s easier to visualize the remaining budget and avoid overspending.

To help keep track of our budget, consider utilizing free budget printables to record the allocated cash and monitor our spending throughout the month.

Remember, the cash envelope system might require adjustments as we adapt to our new budgeting method. With time and commitment, this system can help us gain control over our finances and achieve our financial goals.

Advantages and Disadvantages of the System

Benefits of Cash Envelope Budgeting

The cash envelope system offers several advantages to those who diligently follow it. First and foremost, it encourages discipline in budgeting, helping people avoid overspending in specific categories. By physically dividing cash into separate envelopes, individuals become more aware of their spending limits and are less likely to exceed them.

Another significant benefit of this system is that it eliminates the reliance on credit cards. As a result, users can avoid the costly interest and potential debt associated with credit card usage. Additionally, the cash envelope system pairs well with other budgeting methods, such as the 50/30/20 Rule, to further enhance financial management.

Limitations and Potential Drawbacks

Despite its advantages, the cash envelope system also has some limitations. A primary drawback of this method is that users miss out on credit card rewards. Many credit cards offer cashback, miles, or other perks that can save money or provide added benefits to cardholders. By strictly using cash, individuals are unable to take advantage of these rewards.

Another issue with the cash envelope system is the inconvenience of handling physical cash. In today’s increasingly digital world, carrying around cash can be cumbersome and risky, as it exposes individuals to potential loss or theft. Also, many transactions today are made online or through mobile applications, where cash cannot be utilized.

Moreover, tracking expenses can be more challenging when using the cash envelope system, as opposed to digital budgeting tools that automatically categorize expenses and provide visual representations of spending patterns.

In conclusion, the cash envelope system presents both advantages and disadvantages. While it fosters discipline and discourages credit card usage, it also limits potential rewards and may not be the most convenient or comprehensive option for managing personal finances.

The Cash Envelope System and Modern Solutions

Transition to Budgeting Apps

In recent years, there has been a huge shift towards digital solutions for budgeting and personal finance. Traditional cash envelope systems have given way to budgeting apps that provide similar benefits while embracing the convenience of the digital age. We have witnessed this transition as more people move away from using physical cash envelopes to budgeting apps that offer a similar approach.

Most of these budgeting apps provide a digital version of the cash envelope method, allowing users to allocate funds to different budget categories, just like they would with physical cash envelopes. Furthermore, budgeting apps make it easy to track expenses in real-time, adjust budgets as necessary and receive notifications when you’re close to overspending in a particular category. Some popular apps that follow the cash envelope approach include:

- You Need a Budget (YNAB)

- Mvelopes

- Goodbudget

- EveryDollar

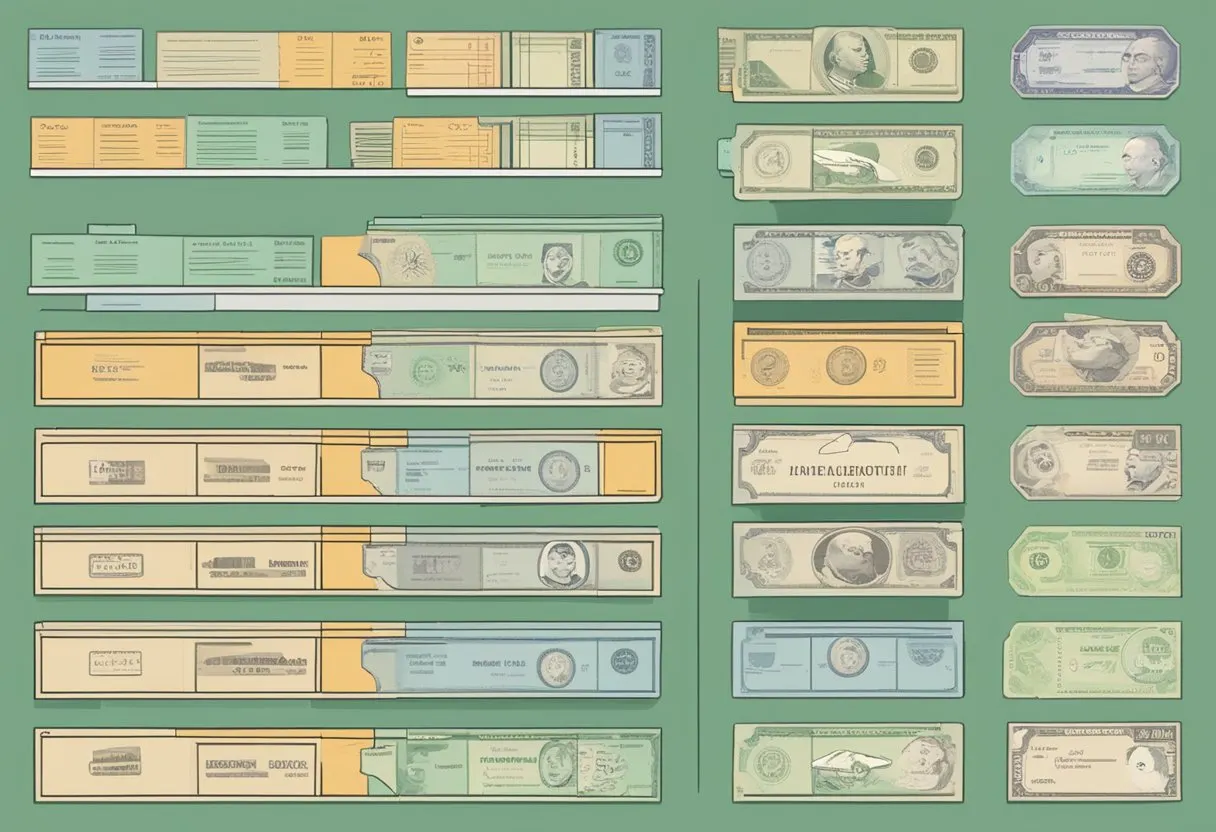

Physical Cash Versus Digital Money

Although digital budgeting apps have numerous advantages, there are still some aspects to consider when choosing between physical cash envelopes and digital money. Let’s break it down in a table to make it easier to compare the pros and cons:

| Physical Cash Envelope System | Digital Budgeting Apps | |

|---|---|---|

| Tactile Experience | Yes | No |

| Real-Time Tracking | No | Yes |

| Safety | Risk of theft or loss | Safer: Funds are stored electronically |

| Ease of Use | Manually updating | Automatic and easy to update |

| Budget Categories | Limited by number of envelopes | Multiple categories can be added easily |

While physical cash envelopes provide a tactile experience, helping users feel more in control of their money, they don’t offer the same level of convenience and security as digital budgeting apps. In addition, it may be more time-consuming to manually track expenses and update envelopes.

On the other hand, digital budgeting apps provide real-time tracking of expenses, ease of use, and flexibility with budget categories. They can also be accessed through various devices, making it easier to stay on top of your budget anytime and anywhere.

Another factor to consider is the increasing reliance on credit cards and mobile payments in today’s society. Physical cash envelope systems might face challenges integrating with these payment methods, while digital budgeting apps generally provide better support for both credit card and mobile payment transactions.

We hope this overview helps you understand the differences between the cash envelope system and modern budgeting solutions. Ultimately, the choice between cash envelope budgeting and digital budgeting apps will depend on personal preferences, financial habits, and the level of comfort with technology.