Almost everyone I know lives paycheck to paycheck and I used to be one of them so I know how stressful it can be.

It is very easy to fall comfortably into this type of living until an unexpected expense occurs and suddenly your bills go unpaid or you cannot pay for whatever expense came up. 😑

So how do we avoid this?🤔

How to stop living paycheck to paycheck?

It can be done and fairly easily if you follow the tips below and actually TRY to change your lifestyle a bit, trust me it will be worth it!

Let’s get to it!👍

Pin for later:

[ReviewDisclaimer]

Related: 5 things you need to know before budgeting

1. Start a Budget

I don’t believe there is a way around this step, you absolutely need a budget. Having a budget is important because it shows you where your money is going AND how much is coming in VS going out.

You need to know where your money is going in order to break this cycle.

Grab a budget planner to help you keep track of all your finances. Personally I prefer to have a paper budget planner but there are many budget apps you can get also.

Will a budget planner help me?

If you are the type to always be behind on your bills and can never seem to catch up or establish a savings then a budget planner will help you immensely!

Budget planners help you stay on task with weekly and monthly spending spreads as well as goal tracking and so much more.

I recommend Erin Condren’s Deluxe Monthly Planner, this is the perfect planner for budgeting and goal tracking.

2. Have an Emergency Fund

Having an emergency fund is essential to sticking with your budget and not living paycheck to paycheck. This fund would be for those unexpected expenses such as:

- Vehicle breaking down

- Problem with house

- Medical problems

the list goes on…

To get your emergency fund fast I would try to sell some items you no longer need or use around the house, you can also find some more tips about how to get an emergency fund fast.

3. Start Saving

Once you have an emergency fund, you can now start putting some money aside into a savings account.

Don’t worry if you are horrible at saving or don’t have very much to put aside, below I will show you a helpful app

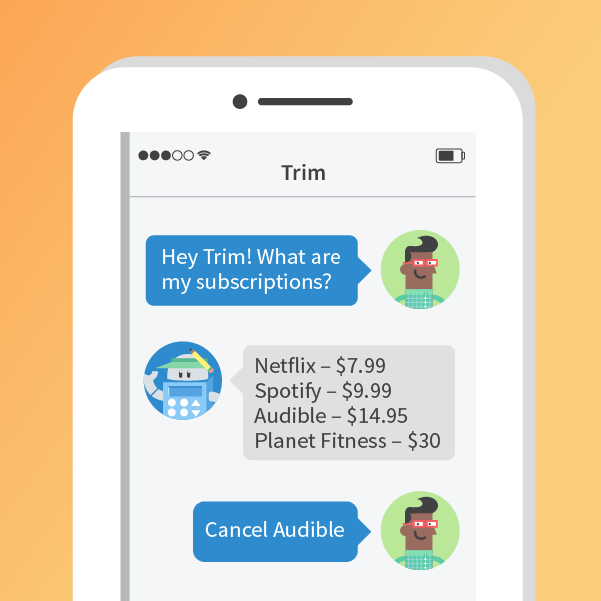

Use Trim your Personal Finance Bot

Trim can fully automate your savings and make it easier then ever to cut back on unnecessary expenses.

Trim will negotiate your bills for you so you don’t have to spend hours calling and being on hold.

Trim can also cancel any subscriptions you no longer need, check credit card finance charges, auto-payments, late fees and so much more!

How to still buy what you want

Budgeting is great but I am sure most of us would still like to splurge on our wants once in a while. Giving up what we love to do can be very depressing and we don’t want that!

To help this, here are some great ways to earn some side cash so you can spend money on whatever you’d like without touching your budget. 😋

Use your points cards

Keeping track of your points cards can really benefit you. In Canada we have a ton of different points cards:

- Airmiles

- PC Points

- Gas cards

Just to name a few.

So what I do, is save up the points and use those for my wants, for example the PC points is for groceries, Once I hit $20 I will stalk up on some junk food.

Earn Free Money

Earning free money is a great way to save money and still buy what you want.

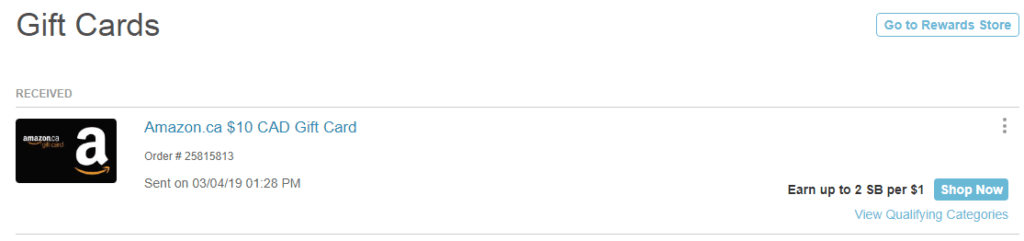

My favorite way to earn money is through Swagbucks. There are so many ways to earn points (which you then cash out), you can easily make enough to buy some of your wants.

Above is one of my gift cards from Swagbucks.

The best thing about Swagbucks is they have very low payout thresholds, so if you wanted you can redeem your points for Paypal cash with only 3,000 points which is equivalent to $3.

There are many other places you can exchange for gift cards such as Starbucks, JCPenny, iTunes and even paypal money.

4. Pay off your debts

Once you have an emergency fund and you have started a savings, you can plan for paying off your debts!

Check out my 8 step plan to getting rid of your debt!

5. Make more money

There are plenty of ways to make some extra money which you can then use for savings. *This money is NOT included in your budget*

Thanks to the internet we now have more options to make money from home, side hustles are very popular and a lot of people don’t take advantage of them!

Some easy ways to make extra money online

Survey sites are one of the fastest ways to make money, it does take some time to fill out the surveys but depending on how quick you are and which surveys you qualify for you could make some killer cash very fast!

Survey Junkie is a very popular legit survey site you can start for free today! I always recommend opening a new email address because they will be sending you emails with offers and it can become crowded in your email box.

Earn when you do shop! Using cash back websites or apps are great ways to earn some free money, one of my favorites is Rakuten (formerly Ebates).

What you do is sign up for free here, then anytime you want to purchase something online go through their website and you will earn cash back on your purchases!

Related: 20 Legit Ways to Make $100 Every Day